How to Overcome Today’s Homeownership Hurdles

Feeling priced out of the housing market? You’re not alone. A recent Bankrate survey found that 78% of would-be homebuyers cite affordability as their top concern.

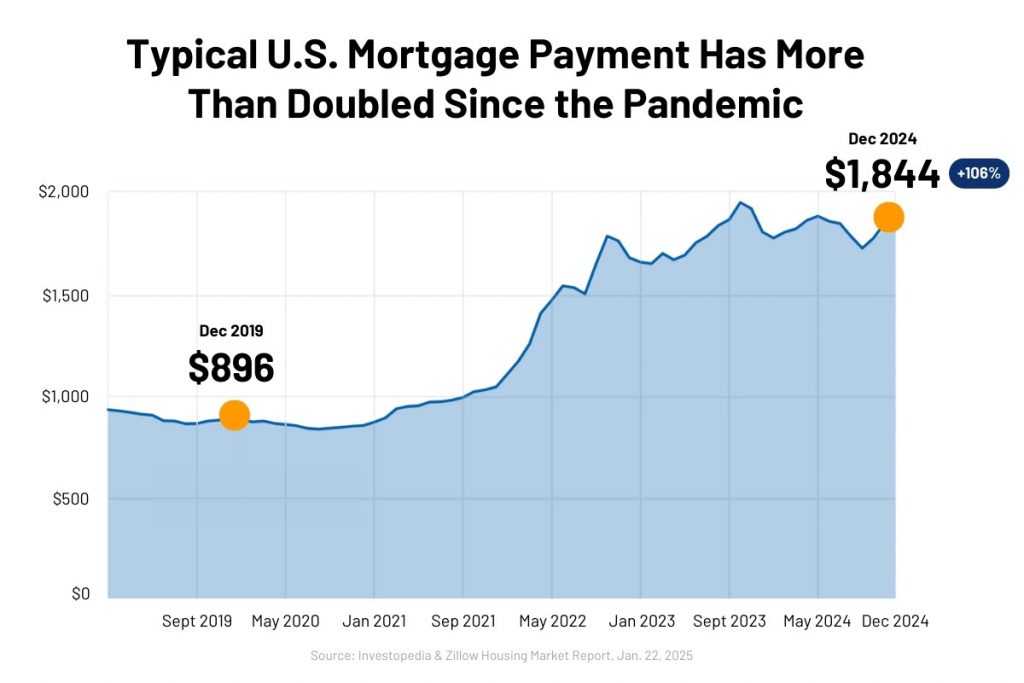

Since the pandemic, home prices have surged over 30%, and mortgage rates have more than doubled—causing monthly payments to skyrocket.

💰 In December 2019, the average mortgage payment was $896. By December 2024, it jumped to $1,844—a 106% increase.

(Source: Investopedia, Zillow)

Despite these challenges, homeownership is still within reach. With the right knowledge, strategy, and guidance, you can navigate these obstacles. Below, we’ll explore five common roadblocks to buying a home—and how to break through them.

1. “I Don’t Have Enough for a Down Payment”

Think you need 20% down? That’s a common myth. Here are smarter options:

-

Low Down Payment Loans – Most conventional loans only require 3-5% down.

-

Down Payment Assistance (DPA) – Many programs offer grants or low-interest loans to help cover your upfront costs.

-

Zero-Down Options – VA loans (for military/veterans) and USDA loans (for rural areas) offer 0% down options.

-

Gifted Funds – In 2024, 25% of first-time buyers received help from family or friends.

-

Use Home Equity – Already own a home? You may be able to use your equity to fund your next purchase.

👉 Ask us how to qualify for down payment assistance in your area.

2. “I Can’t Afford the Monthly Payment”

Monthly mortgage costs are higher, but you have options:

-

Adjustable-Rate or Hybrid Mortgages – Lower initial rates mean lower payments early on.

-

Buy Down Your Rate – Purchasing discount points can reduce your long-term interest rate.

-

Seller Concessions – In some cases, we can help you negotiate for the seller to cover costs or buy down your rate.

-

Co-Buying – Teaming up with family or friends can make ownership more affordable.

-

Income-Producing Properties – Homes with basement apartments, in-law suites, or short-term rental potential can generate extra income.

3. “I Can’t Qualify for a Mortgage”

Qualifying for a mortgage isn’t always easy—but it is possible.

-

Boost Your Credit Score – Pay bills on time, reduce balances, and dispute any errors.

-

Lower Your Debt-to-Income Ratio – Pay off credit cards or loans to improve your numbers.

-

Apply for an FHA Loan – Great for buyers with lower scores or limited savings.

-

Use a Co-Signer – A trusted co-borrower can strengthen your application (with shared responsibility).

📈 Even small changes to your credit and debt can make a big difference!

4. “I Can’t Find a Home in My Budget”

With limited inventory, buyers may need to get creative:

-

Widen Your Search Area – Consider neighboring communities with lower prices.

-

Adjust Your Must-Haves – Can you live with one bathroom? Or finish a basement later?

-

Consider Fixer-Uppers – These homes offer potential equity and lower upfront costs.

🔍 We can help identify hidden gems and negotiate repair credits or renovation budgets.

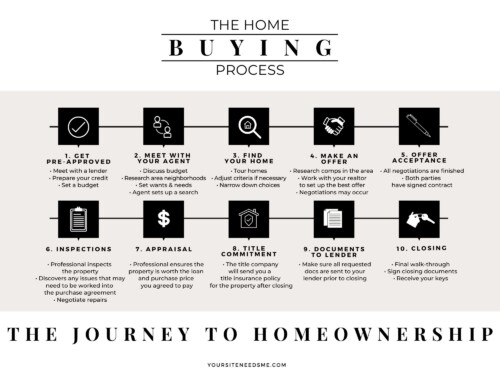

5. “I’m Overwhelmed by the Process”

You don’t have to do this alone. We help you:

-

Find Homes Faster – We narrow down options to match your needs and budget.

-

Simplify Financing – Connect with trusted lenders and explain your options clearly.

-

Manage Contracts & Inspections – We handle the details so nothing gets missed.

-

Negotiate the Best Deal – From price to repairs, we advocate for you at every step.

-

Offer Ongoing Support – After closing, we’re still here for upgrades, resale advice, and more.

✅ You’ll have a trusted guide from the first showing to your closing day—and beyond.

Let’s Make Your Homeownership Dream a Reality

Yes, the market is more complex today—but that doesn’t mean your dream is out of reach.

We’re here to help you:

-

Explore financing options

-

Access assistance programs

-

Find the right property

-

Navigate the entire buying process with confidence

📞 Contact us today to schedule your free homebuyer consultation.

Let’s turn these roadblocks into stepping stones toward your new home.

Disclaimer: This article is for informational purposes only and does not constitute legal, financial, or tax advice. Please consult with qualified professionals regarding your personal circumstances.